Polymarket is a prediction marketplace where opinions are given a price tag. In this review, we will introduce you to this platform and guide you through how to use Polymarket, from creating an account and working with USDC, to selecting a market, managing your position, and cashing out. We will compare it to traditional betting, explain the fees and risks, and give you tips on how to avoid mistakes.

Polymarket

Thanks to Polymarket prediction markets, you can trade directly against other users with 0% fees

Polymarket is a decentralized prediction market where the market itself sets prices instead of a bookmaker. Instead of odds you see percentages, and instead of a bet slip you hold a YES/NO contract that settles at 0 or 1 USD. You trade against other users and can realize profits or limit losses at any time before the event ends. Everything runs on the USDC stablecoin on supported chains. We’ll show you how to deposit funds, set up a wallet (or a quick email account), and use this platform safely.

Best CRYPTO BONUSES in online casinos

What Polymarket is and how it works

Polymarket is a prediction marketplace where you don’t play against a bookmaker, you trade with other users (peer-to-peer). Each market is a question with a “yes” or “no” outcome, and the price of one “share” directly reflects the probability currently assigned by the market. If you see a price of 0,38, the market is saying it gives the event roughly a 38% chance. At final settlement, the correct option settles at 1,0 and the incorrect one at 0, so if you buy “yes” at 0,38 and that scenario indeed happens, you receive 1,0 per share and the difference is your profit.

The essential difference from sportsbooks is that you’re not locked into a bet slip until the end. You can sell, add to, or fully close your position at any time while the market is live, based on new information. The closer the event and the more news flows, the faster the price moves and reflects collective expectations. For example, if your selection strengthens and the “yes” price climbs from 0,38 to 0,62, you can realize part of your profit before settlement and reduce the risk that the market turns against you at the end.

Under the hood, everything runs on cryptocurrency infrastructure and settlement is in the USDC stablecoin. That means fast transfers, but also small fees and the need to have your wallet set up correctly. If you’re new to crypto, you’ll appreciate that alongside a classic self-custody wallet you can use a more convenient email login with a built-in wallet. In this review we’ll walk you through both paths and point out the security essentials you shouldn’t overlook.

Liquidity plays an important role. On markets with enough counterparties, you can buy and sell without notable deviations from the displayed price, while on thinner markets you may encounter slippage, where larger positions move the price noticeably. In practice, this means trading is smoother on major topics like elections, big sporting events, and popular tech themes, while for less mainstream events it’s better to use smaller sizes and patience.

Every market has clearly described rules and a source from which the result will be derived. It pays to read these rules before buying, because they define exactly what counts as “yes” and what as “no” and how to proceed in case of ambiguity. In the event of a dispute, there is a process in the background that allows the decision to be reviewed, so settlement isn’t a matter of chance but of a predefined methodology. For you as a user, that means less room for surprises if you respect the rules.

From a user-experience perspective, Polymarket feels more like a simple exchange than a betting platform. Instead of odds you see percentages; instead of parlay combinations, you manage a single position that you can actively control. If you follow the news, can read context, and want control over a position until the last moment, it’s a logical choice.

Polymarket infrastructure

Polymarket is built on smart contracts that hold funds, settle trades, and govern the rules of each market. These “contracts” run on a blockchain and can’t be unilaterally changed, so the platform itself doesn’t set odds, can’t “rewrite” them, and doesn’t have the authority to pay a result different from the predefined rules. Prices arise purely from trading between users. When demand for “yes” is higher, the price rises; when “no” prevails, it falls. The interface you see in the browser is just a gateway to these contracts; the essential logic lives on-chain and remains auditable. Settlement relies on the source specified for each market and on a dispute-resolution mechanism. In practice, it pays to read the rules and data source, because they determine what counts as meeting the condition and when payout occurs.

Fees, limits, and payouts

Polymarket doesn’t charge any trading fee. You also don’t pay platform fees for deposits and withdrawals, but you should account for costs from intermediaries such as exchanges or on-ramps and for blockchain interaction fees. In practice, you’ll pay small fees on deposits and withdrawals, while trading itself has no platform fee.

As for limits, there’s no hard cap at the order book level. Liquidity is the constraint, so larger sizes can move the price significantly. Before committing a large order, it pays to review the order book and consider splitting the trade into smaller parts.

Deposits and withdrawals are in USDC on the Polygon chain. The platform states withdrawals are instant and free on its side. If you withdraw “bridged” tokens, the interface swaps them via Uniswap into native USDC on withdrawal, and for extremely large amounts it can be worth splitting the withdrawal into multiple transactions to ensure liquidity is available.

After a market is resolved, winning shares settle at 1 USD per share and the losing ones go to zero. The payout occurs once the result is written to the smart contract, and you can then withdraw your balance to your wallet. If you plan to trade actively, it’s reasonable to keep a small reserve for potential network fees.

How markets are settled

Each market has predefined rules and a source by which the outcome is judged. When the outcome is clear, a resolution is proposed and, under UMA’s Optimistic Oracle, a bond is posted as a guarantee of correctness. If no one raises a challenge during a short window, the proposal is accepted and the market closes. If someone disputes the outcome, the dispute moves into UMA’s process, where there’s an open discussion followed by a vote of UMA token holders. This mechanism acts as a safeguard against incorrect proposals and ensures that the platform itself doesn’t determine outcomes.

In practice, this means two things for you. First, always read a market’s rules before buying and verify how “yes” and “no” are defined and which source will be used. Second, be aware that if a challenge occurs, final payout can take a bit longer as the system waits for the UMA dispute result. However, it’s a transparent, on-chain process with clear timeframes and incentives for both sides, not a platform decision.

Prediction markets vs. sportsbooks

At first glance they may look similar, but they serve a somewhat different betting style. In a traditional sportsbook you stand against the bookmaker, who publishes odds and includes a margin. By placing a bet, you commit until the end, and if you want to react to new information, it often means placing additional bets or relying on limited cashouts. On a prediction market like Polymarket, you trade with other users and prices behave like probabilities. You can buy at any time, sell part of your position, flip to the other side, or realize profit before the event ends. It’s suitable wherever time-sensitive information matters and active position management makes sense. Typical examples include longer-term events with news and twists—such as elections, team transfers, injuries, regulatory announcements, or technology milestones.

A sportsbook has advantages where you want specific same-game combinations, very detailed live betting with micro-bets, or the comfort of a fully fiat environment without handling a crypto wallet. A prediction market excels in transparent pricing, the ability to enter and exit at any time, and the direct translation of new information into “price” (percent) moves. If you think in probabilities, follow the news, and want control over your position, Polymarket will likely suit you better. If you prefer same-game accumulators and don’t want to deal with crypto, a classic sportsbook remains more practical.

Where and under what conditions you can play

Polymarket operates as a non-custody web3 app. You connect a wallet, trade in USDC, and the platform typically doesn’t require KYC. That’s a consequence of its infrastructure. You hold the funds, transactions and settlement occur via smart contracts, and the interface merely acts as a gateway. In practice, outside specifically restricted jurisdictions, you can start trading without uploading documents if you have funds on a supported chain.

It’s good to distinguish “what the technology allows” from “what regulation permits.” In 2022, Polymarket reached a settlement with the U.S. CFTC, paid a fine, and blocked access for U.S. users. Since then, the platform has emphasized it doesn’t serve U.S. residents and has geoblocked U.S. IP addresses.

In September 2025, however, a major shift occurred. The CFTC allowed Polymarket’s return to the U.S. market thanks to using licensed infrastructure (acquiring an exchange under CFTC oversight) and granting a no-action relief for certain obligations. In other words, trading via Polymarket in the U.S. is to operate under a regulated regime that aligns event-contract trading with U.S. derivatives requirements. Expect that for U.S. users this will entail full KYC/AML and other standards familiar from traditional brokers. For users in other countries, nothing essential changes: it remains direct wallet-based usage where the platform doesn’t hold your funds.

The human side of compliance matters too. Past cases showed U.S. customers often tried to bypass blocks with VPNs, which violates the terms of service and may also breach local laws. If you operate from a European country, you’ll typically encounter standard crypto onboarding without KYC, but it’s always advisable to respect local regulations and responsibly tax any gains.

Market offering

Polymarket covers what’s being talked about right now: politics, elections, sports, cryptocurrencies, technology and AI, pop culture, and world events. On the homepage and in the “Browse” view you’ll find thematic sections and quick filters like Trending, Breaking, or Ending Soon, so you can easily get to markets with the most interest and liquidity. In practice, you can switch in a few clicks from presidential elections to NFL games, from hourly “crypto up/down” speculations to cultural events or economic questions.

Events are often grouped into “events” with multiple related markets. In sports, each game has its own page with several questions; in politics, you’ll find side markets alongside the main outcome; and in crypto there are short-term events like “ETH up or down in an hour.” This format lets you focus on the main narrative while still spreading a position across multiple scenarios where it makes sense.

Structure-wise, there are both binary YES/NO questions and “categorical” variants with multiple mutually exclusive options (typically a list of candidates or outcome variants). In both cases, the price represents probability, and with multiple options the sum of prices approaches a hundred percent. Polymarket currently uses a limit order book, so prices arise purely from supply and demand, and the displayed “probability” is the mid between best bid/ask, or the last trade where spreads are wider. That matters for discovery too: markets with tighter spreads and deeper liquidity tend to be more convenient for entry and exit.

New topics are curated by a curation team with active community input. Users can’t create markets themselves, but they can propose them and provide a resolution source and rule definitions. In practice, this results in an offering that reacts quickly to current events—from hurricane categories with a clear National Hurricane Center source to fresh cultural events. If you follow a specific area, use search, topic pages, and third-party watchlists/alerts.

Deposits, currencies, and chains

Polymarket settles in USDC on the Polygon blockchain but accepts deposits from other chains (Bitcoin, Arbitrum, Base, Ethereum, Solana, BSC, Optimism, Abstract) and in many tokens (BTC, USDC, USDT, DAI, BUSD, ETH/WETH, BNB/WBNB, MATIC, POL, CBBTC, ARB, SOL). The deposit wizard automatically bridges/swaps everything into your Cash (USDC). If you’re sending USDC on Polygon, the transfer is the simplest and cheapest. In practice, this means two simple tasks: have a wallet compatible with Polygon (typically MetaMask) and have USDC on the correct chain. The platform doesn’t charge a trading fee or deposit/withdrawal fees on its side. Costs arise when interacting with the chain and potentially with intermediaries you use between your bank and crypto. Typically, you pay gas on Polygon in a small amount of the native token MATIC or POL, especially on deposits and withdrawals.

Supported currencies and chains

|

|

Bitcoin |

Ethereum |

Polygon |

Base |

Arbitrum |

Solana |

BSC |

Optimism |

Abstract |

|

BTC |

✅ |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ | ❌ | ❌ |

|

USDC |

❌ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ |

✅ | ❌ |

|

USDC.e |

❌ |

❌ |

✅ |

❌ |

❌ |

❌ |

❌ |

❌ | ❌ |

|

USDT |

❌ |

✅ |

✅ |

✅ |

✅ |

❌ |

✅ |

✅ | ✅ |

|

DAI |

❌ |

✅ |

✅ |

✅ |

✅ |

❌ |

✅ |

✅ | ❌ |

|

BUSD |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ |

✅ | ❌ | ❌ |

|

ETH |

❌ |

✅ |

❌ |

✅ |

✅ |

❌ |

✅ |

✅ | ✅ |

|

wETH |

❌ |

✅ |

✅ |

✅ |

✅ |

❌ |

❌ |

✅ | ✅ |

|

MATIC |

❌ |

✅ |

✅ |

❌ |

❌ |

❌ |

❌ |

❌ | ❌ |

|

POL |

❌ |

✅ |

✅ |

❌ |

❌ |

❌ |

❌ |

❌ | ❌ |

|

SOL |

❌ |

❌ |

❌ |

❌ |

❌ |

✅ |

❌ |

❌ | ❌ |

|

BNB |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ |

✅ | ❌ | ❌ |

|

wBNB |

❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ | ❌ | ❌ |

|

CBBTC |

❌ |

✅ |

❌ |

✅ |

❌ |

❌ |

❌ |

❌ | ❌ |

|

ARB |

❌ |

❌ |

❌ |

❌ |

✅ |

❌ |

❌ |

❌ | ❌ |

How to deposit USDC to Polymarket (MetaMask + Polygon)

TIP: You don’t necessarily have to send USDC on Polygon. Via the Deposit button, you can deposit ETH/USDT/MATIC and other tokens from Arbitrum, Base, Ethereum, BNB Chain (see the table above). The deposit wizard will automatically convert them to USDC in your Polymarket wallet. However, expect a bridge/swap fee from the provider.

- Prepare your wallet and chain

Install MetaMask (https://metamask.io/) and add the Polygon PoS network if it’s not already in your list. MetaMask knows the network natively. If needed, you’ll find the steps in the help. For future transactions, keep a small amount of MATIC/POL in your wallet for fees. - Get USDC on the correct chain

You can send USDC to Polymarket in two ways. Either send USDC on Polygon directly, or send USDC on Ethereum and Polymarket’s interface will automatically bridge it to Polygon. If native USDC arrives, the app may prompt you to “activate” it. Under the hood, a small swap via Uniswap to USDC.e occurs with negligible slippage. - Connect your wallet and open a deposit

On Polymarket, click Deposit, choose the source of funds, and follow the wizard. For “from wallet / Exchange → Polygon” deposits, copy the address, verify you are indeed sending USDC over the Polygon network, and execute the transaction. Sending on the wrong chain typically leads to loss of funds, so if unsure, start with a test amount. - Keep a bit of gas for fees

You pay network fees in MATIC/POL for deposits and withdrawals. If you have none, Polygon offers “Swap for Gas,” where you can obtain the needed gas from a small portion of other tokens. Most users need only a few MATIC/POL for dozens to hundreds of actions. - Check your “Cash” balance and trade

After confirmation, you’ll see available Cash (USDC) in your account and can buy or sell positions.

How to sign up and deposit via email

With email, Polymarket creates a smart-contract wallet (Proxy Wallet) that’s tied to your account via email verification. In the documentation, Polymarket refers to it as an “Email/Magic account,” and it’s technically handled by a proxy layer for signing and order submission. For you, it’s simply a convenient built-in wallet without installing a browser extension.

- Open Polymarket and choose “Continue with Email”

Enter your email address. You’ll receive a magic link / one-time code to log in. After confirmation, a built-in smart wallet is created in the background, which you’ll use for trading. - Verify your email and complete the first login

Clicking the link (or entering the code) activates the account. There’s no need to install MetaMask or configure anything; you’ll immediately see the interface with a “Cash” balance (0 USDC for now). - Open “Deposit” and choose a top-up method

The wizard offers two main paths:

- Payment card / on-ramp partner: easiest for beginners, but the provider may require KYC and charges its own fees.

- Send crypto from an exchange/wallet: copy your Polygon USDC address and send USDC to it from an external wallet/exchange. Make sure it’s truly USDC on the Polygon network.

- Wait for confirmation and start trading

Once the deposit arrives, “Cash (USDC)” is credited and you can buy/sell positions. With the built-in wallet, Polymarket handles transaction signing for you. For regular trading, you don’t need to install anything else.

How to withdraw correctly

Withdrawals are available in USDC and USDC.e. If you’re withdrawing to an exchange or service, verify what exactly it supports. Some platforms no longer accept USDC.e and require native USDC. In Polymarket’s interface, you can choose the withdrawal form. For large amounts, it makes sense to split the withdrawal into multiple transactions to ensure liquidity. After markets settle, winning shares pay out at 1 USD per share and you can transfer your balance back to your wallet at any time.

Common issues and how to avoid them

If you “don’t see” the funds, it’s usually the wrong network or mixing up USDC/USDC.e. Always check the network in MetaMask and the token contract symbol. Remember, fees are charged only when moving funds in or out; during trading itself you don’t deal with gas. Finally, security: Polymarket enables a convenient email account, but from a security perspective we recommend a standard wallet and basic hygiene—a backed-up seed phrase, 2FA on exchanges, resistance to phishing, and ideally a hardware wallet (Trezor/Ledger).

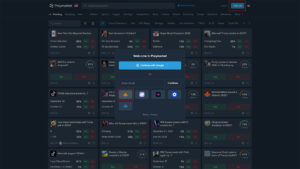

User interface and tools

Polymarket feels more like a simple exchange than a classic sportsbook. The homepage offers an overview of trending topics and quick filters. A market’s detail view combines a price chart, rule overview, and resolution source with an order book and a buy/sell panel. You can trade at market (instant entry) or with limit orders, letting you wait for your ideal price and keep tight control over both entry and exit. The order book is transparent; you see the best bids and asks and market depth.

The mobile app is available for both iOS and Android. The mobile interface is fast and optimized for phones, so you can track prices, browse events, and place orders quickly on the go. If you don’t want to install the app, the website is responsive in mobile browsers.

For more active use, a few small features help: in the market detail you have a quick Yes/No toggle, you can see trade history and when the market closes. In your account you’ll find a positions overview, open orders, and your “Cash” balance. The official app doesn’t yet offer native price alerts for arbitrary markets, but there are community tools for watchlists and real-time alerts via Telegram or Discord that hook into Polymarket’s data.

Overall, it’s a clean, fast, and clear UI that prioritizes working with probabilities and orders. If you’re used to an exchange, you’ll feel at home. If you’re coming from sportsbooks, you’ll appreciate having everything essential—market rules, the order book, and a take-profit button—in one place.

Benefits and features (pros and cons)

- Transparent “odds” = market probabilities in %

- 0% platform fee on trades

- No KYC, fully decentralized platform

- Enter/exit anytime (manage a position before settlement)

- Limit orders and an open order book

- Strong liquidity in major topics (elections, big events)

- Fast USDC deposits/withdrawals on Polygon

- Convenient email login with a built-in wallet

- Mobile app for iOS and Android + responsive web

- Clear market rules and on-chain settlement (UMA dispute process)

- Non-custody model; you hold funds in your own wallet

- Active community (Discord, X) and a public status page

- Wide range of markets (politics, sports, crypto, tech/AI, pop culture)

- Need to handle crypto (USDC on Polygon) and keep a bit of MATIC/POL for fees

- Missing classic betting features like BetBuilder/same-game parlays

- Final payout in disputes can take longer due to the on-chain process

- Wider spreads/slippage on less liquid markets

- No official in-app price alerts yet (community solutions exist)

Is Polymarket the right choice?

If you think in probabilities, follow the news, and want the option to enter and exit based on new information, Polymarket will suit you better than a classic sportsbook. Prices here aren’t “bookmaker odds,” but live market estimates, so you can quickly take profit, reduce risk, or completely change your view before the event ends. Polymarket is weaker where you need complex same-game combinations, micro-bets in live, and a standard fiat environment without a wallet and crypto. In short, for data-oriented bettors who want transparent probabilities and position control, it’s an excellent choice.

Support and community

You can find official support directly on Polymarket’s website via the blue chat icon in the bottom right corner. Submit your question and you’ll handle it immediately in live chat with the team. Alternatively, you can open a ticket on the official Discord server in the Support section, where the issue is handled privately with a support agent. The platform recommends both channels as primary. On social media, Polymarket is most active on X (Twitter), where the main account is @Polymarket. You’ll also find an official link to Discord.

There’s a public status page with email, Slack, or RSS notifications for service status. It’s handy when you’re not sure whether the problem is on your side or an outage.

Overall, the Polymarket ecosystem is lively and easy to reach. Fast website chat, Discord tickets, a status page, and an active X profile cover most situations, from a “stuck” transaction to questions about market rules.

Specifications

©️Owner |

Blockratize, Inc. (d/b/a “Polymarket“) |

🗓️Founded |

2020 |

🖥️Devices |

Desktop, mobile web, iOS app, Android app |

📜License |

Decentralized platform |

🎲Products |

Prediction markets |

📺Live streams |

No |

💲Currencies |

USDC on the Polygon chain |

🗨️Language |

English |

💳Payment methods |

|

👩💻Support |

|

Frequently asked questions

Don’t miss:

- Cryptocurrencies

- How to buy crypto for a casino deposit

- How to use crypto safely

- How to send crypto to a casino safely

- Most-used cryptocurrencies in casinos

- Crypto bonuses and promos

Discussion, comments and your experiences

Share your opinion, ask a question, or offer advice to others in the moderated discussion. Editors also participate, but they respond based on their current availability. If you expect a direct response, we recommend using email communication instead.

What is this?

Hello, Louis,

Polymarket is a prediction-market platform where users bet on the outcomes of future events using cryptocurrencies.