How to buy cryptocurrency for depositing into an online casino easily and without unnecessary mistakes. We’ll explain what to prepare, which payment methods to choose, and how to avoid fees that are often overlooked by newcomers.

How to buy cryptocurrency for depositing into an online casino

Choosing a quality exchange to buy crypto for a casino deposit is very important and will save you unnecessary fees

We’ll walk you through step by step how to buy crypto on verified platforms. Everything from creating and verifying an account, choosing a payment method, to buying the currency and withdrawing to the casino address. We’ll explain how to choose the right network, when stablecoins make sense, and what to watch out for so your payment arrives without delay.

Popular payment methods

Where to buy?

If you want to buy crypto purely to deposit into a casino, the goal is simplicity, fast onboarding, and reasonable fees. In practice, that means choosing a verified on-ramp, completing a short KYC, and deciding whether to pay by payment card (instant, but with a higher fee) or SEPA transfer (cheaper, but can take up to 2 days).

The most used platforms include Binance, Kraken, Coinbase, Bitstamp, and Coinmate. All of them allow purchasing from a wide selection of coins and stablecoins. The differences are mainly in the user interface, supported payment methods, and withdrawal fees. Before choosing, check which network (TRC20/BEP20/ERC20, etc.) your casino accepts for the given currency.

It’s also important to think about total costs. Besides the purchase fee, the spread (exchange rate), the withdrawal fee, and the network fee on the chosen chain matter. Below we’ll show a detailed purchase flow on one platform step by step.

SEPA transfer or payment card?

The fastest route isn’t always the cheapest. Before your first purchase, decide whether you care more about speed or total costs.

Payment card

You’ll appreciate a card when you want crypto right away. On most platforms, the purchase is credited instantly and you can proceed to withdraw to the casino. However, expect a higher processing fee and often a worse rate. The bank may sometimes require extra verification (3D Secure), and declines aren’t uncommon. Some services briefly restrict withdrawals after a card purchase for security. If you’re in a hurry, verify this on your exchange.

SEPA bank transfer

SEPA is usually the most cost-effective in terms of fees and rates. EUR deposits to European exchanges are often free or for a symbolic fee. Limits are generally higher than with cards. The downside is time, typically 2 business days (sometimes the same day if you send in the morning and your bank supports instant SEPA payments). With SEPA, you must send from an account in your own name (matching the KYC name), otherwise it may be returned or delayed.

Best online casinos

Binance

The world’s largest exchange with a wide selection of coins and withdrawal networks (for popular tokens usually ERC20/BEP20/TRC20, often more). For the “on-ramp → deposit to casino” process, it’s a convenient choice. EUR bank transfers (SEPA) and card purchases are available in supported countries, onboarding is fast and the app is clear.

- Strengths: huge liquidity, good rates, many withdrawal networks = easy to find what your casino supports.

- What to consider: card purchase fees are higher than SEPA. The availability of some fiat methods varies by country and verification.

Fees:

- SEPA (EUR): Binance quotes a €1 fixed fee for SEPA Instant (illustrated in the official guide. Availability and fees may vary by provider and country).

- Payment card: the fee varies by provider. Official materials mention a rate “up to around ~2%” (the actual rate is shown at checkout).

Kraken

An exchange focused on regulation and security, with long-standing strong support for EUR and SEPA (including SEPA Instant via providers like Banking Circle/Ivy). Card purchases are possible but tend to be more expensive. Most users first make a SEPA deposit and then buy on spot. Network withdrawals are clear and conservative (fewer “exotic” networks, but a very solid backend).

- Strengths: stable EUR/SEPA environment, reputation, good support.

- What to consider: card purchases are more of a last resort due to higher fees. Some fast networks may not always be available for every token.

Fees:

- SEPA (EUR): deposit free, withdrawal €1 according to the official EUR overview.

- Payment card / “Instant Buy”: Kraken charges a special fee for these purchases shown at payment (higher than spot). See the official pages for method details and limits.

Coinbase

The simplest user interface for beginners. Registration, KYC, and purchasing are guided step by step, SEPA transfers in EUR are supported, and anyone can handle card purchases. For the lowest costs, Coinbase Advanced is worth it (lower fees than the “simple buy”). For withdrawals to online casinos, note that Coinbase traditionally supports mainly ERC20 (for stablecoins, etc.). Some cheaper networks may not be available.

- Strengths: extremely easy to use, big brand, good banking links in the EU.

- What to consider: the “simple buy” has a higher spread/fee. A more limited set of cheap withdrawal networks can make the on-chain part pricier. (SEPA/EUR withdrawals are described in Coinbase Help.)

Fees:

- SEPA (EUR): retail Coinbase quotes €0 for SEPA deposits. In the Coinbase Exchange section you’ll find an overview with €0.15 for a SEPA deposit and SEPA withdrawal free (varies by product/country. If using Advanced/Exchange, check which account you’re on).

- Payment card: fees are variable and shown at confirmation. Coinbase also applies a spread (see the official “Pricing & fees disclosures”).

Bitstamp

One of the longest-running EU exchanges (2011+), SEPA deposits/withdrawals in EUR are standard, as is the option to buy by card. The interface is simple, fees and procedures are transparently published in the official fee schedule. The network portfolio for withdrawals is rather “classic,” which is often sufficient for i-gaming (BTC, ERC20, and others for selected assets).

- Strengths: long history, European jurisdiction, clearly described fees.

- What to consider: fewer “alternative” networks than the biggest exchanges. Card fees tend to be higher than SEPA. (See Bitstamp’s official site for fees and guides.)

Fees:

- SEPA (EUR): Bitstamp has long supported SEPA deposits/withdrawals (including SEPA Instant where available); exact fees are in the schedule/checkout.

- Payment card: 5% fee for card purchases (with possible additional issuer costs), per official support.

Coinmate

A Czech/Slovak choice with strong support for Czech koruna and EUR. A great option if you want to send koruna from a Czech bank and quickly buy BTC/LTC/XRP or other supported coins. SEPA transfers in EUR and local options for koruna, simple verification and Czech-language support. Ideal as a quick and understandable on-ramp for CZ/SK users.

- Strengths: local currencies (Czech koruna/EUR), beginner-friendly simplicity, Czech interface.

- What to consider: a smaller range of coins and sometimes fewer withdrawal networks than global exchanges. For some casinos, a global exchange may be more practical.

Fees:

- SEPA (EUR): deposit €1, withdrawal €1.

- Bank transfer: deposit €0, withdrawal €3.

- Payment card: 1.9% (EUR), 4.9% (Czech koruna).

Identity verification (KYC)

In the crypto world, identity verification is standard. It’s required by anti-money laundering and counter-terrorism regulations. Practically, it means faster deposits/withdrawals, higher limits, and a lower risk of declined payments. The process varies slightly between platforms, but it’s broadly similar everywhere.

What you’ll usually need

- Personal details (name, date of birth, address) and contacts (email, phone).

- Identity document: ID card or passport; sometimes a driving licence depending on the country.

- Selfie: a short video or face photo to verify the document belongs to you.

- Proof of address (PoA): bank statement/utility bill with your name and address, typically not older than 3 months.

- Experience and intended use questionnaire: only on some exchanges.

- Proof of funds (SoF): usually for higher limits.

How platforms differ

- Binance – fast onboarding, typically ID + selfie. Proof of address may be required depending on country and fiat methods used. For withdrawals, name matching checks often run for SEPA/fiat.

- Kraken – clearly structured levels (“Starter/Intermediate/Pro”). Higher levels unlock more fiat rails (SEPA, cards) and higher limits. Requires ID, photo, and usually proof of address.

- Coinbase – phone + photo ID + proof of address. Simple buys have higher fees, but KYC is straightforward.

- Bitstamp – a “bank-like” approach: ID + proof of address are standard; the exchange is known for strong compliance, so for larger amounts it may request additional documents (e.g., proof of funds).

- Coinmate – requires identity document, selfie, proof of address, and a short KYC questionnaire; the advantage is Czech localization and clear limits.

What to watch out for

- Name match: with SEPA, the account must belong to the same person as the exchange account, otherwise a return or manual review may occur. Exchanges explicitly emphasize this for fiat transfers.

- Cards and temporary holds: after a card purchase, some services have a short withdrawal restriction (a security window). Factor this in if you’re rushing to deposit into a casino. Exchanges mention this under “instant buy” documentation.

- Document quality: sharp photos, full edges of documents, legible details. The proof of address must clearly show name + address + issue date.

- Follow-up questions: for higher volumes or sudden spikes in activity, be prepared for a SoF check (bank statements, income confirmation). This is a routine part of AML on leading exchanges (Bitstamp, etc.).

How to buy crypto on Binance

Before we start, this section assumes you have the Binance desktop app, completed registration, identity verification (KYC), and 2FA enabled (ideally via an app, not SMS). Without these, some deposit methods may be limited or unavailable, and withdrawal limits much lower. We’ll show two routes: card purchase (instant, pricier) and SEPA transfer (cheaper, one step longer, because after topping up EUR you’ll buy crypto via “Convert” or on the “Spot” market).

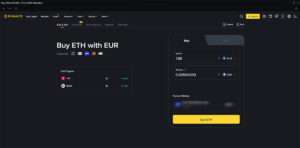

Card purchase

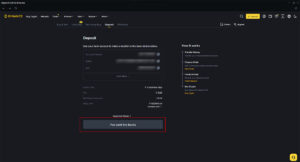

- Go to “Dashboard” and click the “Deposit” button in the top right.

- A panel appears on the right; choose the second button “Buy with EUR”.

- The app opens in a new window where you can choose the fiat currency you want to use for the purchase and the cryptocurrency you want to buy.

- Under the currency selection, expand the payment methods where you can choose between Paymonade, Apple Pay, Google Pay, Card (Visa/Mastercard), or Revolut.

- Select “Card (Visa/Mastercard)” and enter your card details.

- Choose the fiat currency you want to spend (Czech koruna supported) and the cryptocurrency you want to buy.

- Enter the amount of fiat currency you want to spend. Binance will automatically show how much crypto you’ll receive for your fiat.

- Click the yellow button (label depends on the selected crypto), e.g., “Buy ETH”, and complete the transaction. If successful, you’ll find your crypto under “Wallet” and “Overview”.

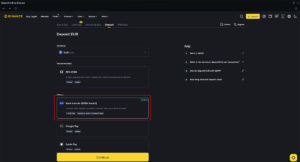

SEPA purchase

- Go to “Dashboard” and click the “Deposit” button in the top right.

- A panel appears on the right; choose the first button “Deposit EUR”.

- The app opens in a new window with several methods. Choose “Bank transfer (SEPA instant)” and click the yellow “Continue” button.

- You’ll now see a window with bank details to enter in your banking app for the SEPA payment (in some banking apps under “Europayment”).

- Note that the minimum deposit is €2 and your bank account must match the KYC information your Binance account is registered with.

- Once you complete the SEPA payment in your banking app, click “I’ve sent the funds”.

- Euros will arrive in your Binance account within 2 days. This wait depends on your bank and the SEPA payment type. Some banks offer priority SEPA for a higher fee. Once the euros arrive in your Binance account, you’ll find them under “Wallet” and “Overview”.

How to exchange euros for crypto (spot trade)

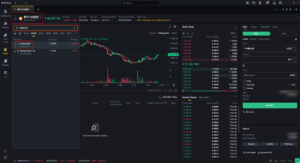

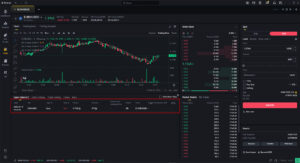

- Go to “Dashboard” and click “Trade” in the left panel.

- The first time, a window appears to choose your preferred UI. Select “Pro” (this guide uses that interface).

- A window with a chart appears where, in the top left, you can search the pair you want to trade (e.g., EUR/USDC). Look up the crypto you want to buy for your euros (not all tokens are paired with EUR).

- Once you switch to the pair you want to trade, focus on the top right “Spot” panel. For EUR/USDC, euro is on the sell side, so choose “Sell” at the top of the “Spot” panel.

- You can choose between “Limit” and “Market”. “Limit” is essentially an order where you set the price you’re willing to pay for the crypto. The downside of a limit is that you’ll have to wait until the token reaches your price. “Market” is an instant buy where you don’t set the token price. The downside is slippage, which at higher amounts can significantly affect how much crypto you receive (lower than with a limit order).

- If you chose “Limit,” enter the token price you want to buy at. If you chose “Market,” just enter the amount of euros you want to spend.

- Click “Sell EUR”. For a market order, you receive your crypto instantly and you’ll find it under “Wallet” and “Overview”.

- For a limit order, your position appears in the bottom left “Open Orders” panel. You can manage the order there. You can change the token price you want to buy at, the amount of euros to spend, or cancel the order. Once the token hits your order price, it will be filled and you’ll find the crypto under “Wallet” and “Overview”.

You’re done with the purchase. Now just make sure to choose the right network when withdrawing and send the crypto to the address from the casino cashier. The key is matching the currency, network, and any required tag/memo. If you want a safe step-by-step walkthrough, continue to our article “How to send crypto to a casino safely”.

Discussion, comments and your experiences

Share your opinion, ask a question, or offer advice to others in the moderated discussion. Editors also participate, but they respond based on their current availability. If you expect a direct response, we recommend using email communication instead.